EMI Calculator App & Loan EMI

All trademarks belong to their respective owners. Get GameEasily calculate home, car, or personal loan EMIs with the EMI Calculator App — the must-have finance tool for accurate monthly planning. Download now and manage smart!

In today’s fast-paced financial landscape, making informed decisions about loans and investments is paramount. This is where the EMI Calculator App becomes your indispensable digital companion. An EMI, or Equated Monthly Installment, is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. It comprises both the principal loan amount and the interest accrued on the outstanding balance. Whether you’re planning a dream home purchase, financing a new car, considering a personal loan for unforeseen expenses, or strategizing your investments, understanding your EMI is the first crucial step towards sound financial management.

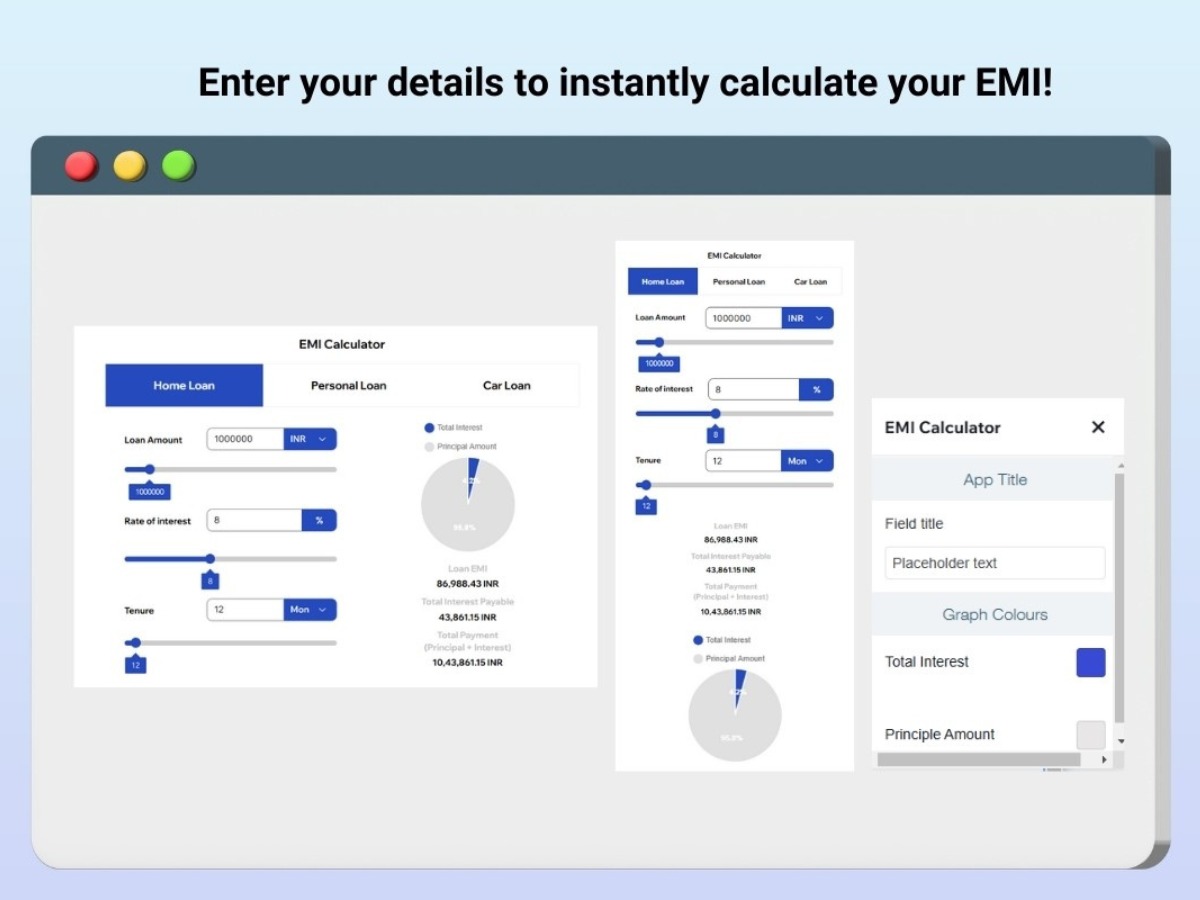

EMI Calculator Apps are powerful, intuitive tools designed to simplify complex financial calculations. Gone are the days of manual spreadsheets and complicated formulas. With just a few taps, these apps provide instant insights into your monthly repayment obligations, total interest payable, and the overall cost of a loan. They empower individuals to assess affordability, compare different loan options from various financial institutions, and plan their budgets effectively. More than just a calculator, the best EMI apps evolve into comprehensive financial management suites, helping users track their loan portfolios, plan prepayments, and even explore other investment avenues like Fixed Deposits (FDs), Recurring Deposits (RDs), and Systematic Investment Plans (SIPs). In essence, an EMI Calculator App is not just a utility; it’s a strategic partner in achieving your financial goals, offering transparency and control over your debt and investment journeys.

The Cutting Edge: July 2025’s Latest Innovations in EMI Calculator Apps

The world of financial technology (FinTech) is constantly evolving, and EMI Calculator Apps are at the forefront of this innovation, integrating new features and user-centric improvements. As of July 2025, the leading apps in this category are pushing the boundaries to offer more comprehensive and intelligent financial planning tools.

Here’s a breakdown of the latest trends and features you’ll find in the best EMI Calculator Apps:

- Advanced Loan Comparison with Visualizations: Beyond simply calculating individual EMIs, top apps now offer robust “Compare Loans” features. You can input parameters for multiple loan scenarios (different principal amounts, interest rates, and tenures) and instantly see a side-by-side comparison of monthly EMIs, total interest paid, and total repayment amounts. Crucially, these comparisons are often presented with interactive charts and graphs (e.g., pie charts breaking down principal vs. interest, bar graphs comparing total costs), making complex data easily digestible.

- Detailed Amortization Schedules: A key feature in 2025 is the provision of a granular amortization schedule (or payment split-up table). This shows you exactly how much of your EMI goes towards the principal and how much towards interest each month, for the entire loan tenure. This transparency is invaluable for understanding how your loan balance reduces over time and for planning potential prepayments.

- “What If” Scenario Planning (Prepayments & Variable Rates): Modern apps go beyond static calculations. They allow users to simulate the impact of part payments or prepayments (monthly, quarterly, yearly, or one-time) on their loan tenure and total interest savings. Some advanced apps even offer the ability to input variable interest rates to model how fluctuating market rates could affect your EMI, providing a more realistic long-term financial projection.

- Integrated Investment Calculators: Recognizing that loan management is part of a broader financial picture, many leading EMI apps now include other essential calculators:

- Fixed Deposit (FD) Calculator: Compute maturity amount and interest earned on FDs.

- Recurring Deposit (RD) Calculator: Determine returns on regular, fixed investments.

- Public Provident Fund (PPF) Calculator: For long-term savings and tax benefits.

- Systematic Investment Plan (SIP) / Mutual Funds Calculator: Project potential returns on mutual fund investments, often including a new Step-Up SIP Calculator to plan for increasing investments over time.

- Inflation Impact Calculator: A crucial new addition as of July 2025, allowing users to analyze how inflation affects their savings and financial goals, providing a more realistic view of future purchasing power.

- Tax Calculation (GST/VAT): For various regions, apps now integrate GST (Goods and Services Tax) or VAT (Value Added Tax) calculators, handy for quick tax estimations on goods and services.

- Loan Eligibility & Documentation Insights: Some advanced apps, particularly those developed by or in partnership with financial institutions, offer loan eligibility estimators based on income and other factors. They may also provide useful lists of required documents for different loan types (home, personal, car), simplifying the application process.

- Personalized Loan Tracking & Notifications: The best apps allow you to create loan profiles for all your outstanding debts (home loan, car loan, education loan, etc.). This enables you to track them together, receive useful statistics on completion, and get notified about upcoming EMI due dates, helping you avoid late payment penalties and maintain a good credit score.

- User Interface & Accessibility: The latest updates prioritize flexible UI, good usability, and intuitive interfaces. Features like multi-currency support, easy sharing of results (PDFs, SMS, email), and even integration with smartwatches (e.g., Apple Watch support) or messaging apps (iMessage support for instant calculations) enhance accessibility and convenience.

- News & Nearby Financial Services Integration: Many apps are now incorporating latest financial news feeds (often powered by Google News) to keep users informed about market trends. Some even include “Nearby Bank Finder” and “ATM Finder” functionalities, leveraging location services for practical, real-world utility.

These advancements reflect a shift from simple calculation tools to comprehensive financial planning and management platforms, designed to empower users with greater control and insight into their financial health.

Understanding Loan EMI: The Formula and Key Factors

At its heart, an EMI calculation is a straightforward mathematical process, but understanding its components is vital for effective financial planning.

The EMI Calculation Formula:

The most common formula used to calculate EMI for a loan with a fixed interest rate is:

Where:

- = Equated Monthly Installment

- = Principal Loan Amount (the total amount borrowed)

- = Monthly Interest Rate (Annual Interest Rate / 12 / 100)

- Example: If the annual interest rate is 8% (), then

- = Total Number of Monthly Payments (Loan Tenure in Months)

- Example: If the loan tenure is 5 years, then months

Example Calculation:

Let’s say you take a personal loan of ₹500,000 at an annual interest rate of 12% for a tenure of 5 years.

- Principal Amount (P): ₹500,000

- Annual Interest Rate: 12%

- Monthly Interest Rate (R):

- Loan Tenure (N):

Now, plug these values into the formula:

Calculate

So, your Equated Monthly Installment would be approximately ₹11,122.

Factors Affecting Your Loan EMI:

Your EMI is primarily influenced by three critical factors:

- Principal Loan Amount (P): The higher the amount you borrow, the higher your EMI will be, assuming other factors remain constant.

- Interest Rate (R): This is the percentage charged by the lender on the loan amount. A higher interest rate directly translates to a higher EMI. Even a small difference in interest rate can significantly impact your total interest paid over the loan tenure.

- Loan Tenure (N): This is the duration over which you will repay the loan.

- Longer Tenure: Generally results in a lower EMI, making monthly payments more affordable. However, you end up paying significantly more in total interest over the longer period.

- Shorter Tenure: Leads to a higher EMI, but you pay less total interest over the life of the loan and become debt-free faster.

Other Influencing Factors:

While not directly part of the core EMI formula, several other factors can affect your loan approval, the interest rate you’re offered, and thus indirectly your EMI:

- Credit Score: A higher credit score signals lower risk to lenders, often allowing you to secure a lower interest rate, which reduces your EMI.

- Income & Employment Stability: Lenders assess your income and job security to determine your repayment capacity. Higher, stable income generally translates to better loan terms.

- Down Payment (for Home/Car Loans): A larger down payment reduces the principal loan amount, directly lowering your EMI.

- Loan Type: Different loan types (personal, home, car, education) typically carry different interest rates based on risk assessment.

- Fees and Charges: Processing fees, legal fees, or other charges associated with the loan, while often paid upfront or included in the total loan amount, can influence the overall cost of borrowing.